The Payment Services Directive 2 or PSD2 has been in full force for more than six months, and its impact is being felt not just in the European Union, but across the globe – with several markets, such as Singapore, Australia, and Nigeria, as well as Hong Kong announcing open banking initiatives inspired by the PSD2. Banks’ long-time monopoly on their customers’ account information and payment services is disappearing.

The European Commission imposed the PSD2 to improve financial services innovation, reinforce consumer protection, and improve the security of internet payments and account access. The directive fosters a broader ecosystem with improved products and services while enabling bank customers – both consumers and businesses – to use third-party providers (TPPs) to manage their finances.

EU banks are now preparing to build necessary capabilities to give TPPs access to customers’ accounts through open APIs (application program interfaces), which allows third-parties to build financial services on top of banks’ data and infrastructure. In the United States, the Consumer Financial Protection Bureau is also pushing for open data while in the United Kingdom, initiatives from the Open Banking Working Group initiative are gaining traction.[1] Moreover, the National Payments Corporation of India’s (NPCI) IndiaStack, as well as programs in South Korea and Australia are encouraging collaboration between various payments industry stakeholders.[2] Central authorities in Hong Kong and Canada have also launched industry consultations on open API frameworks.[3][4]

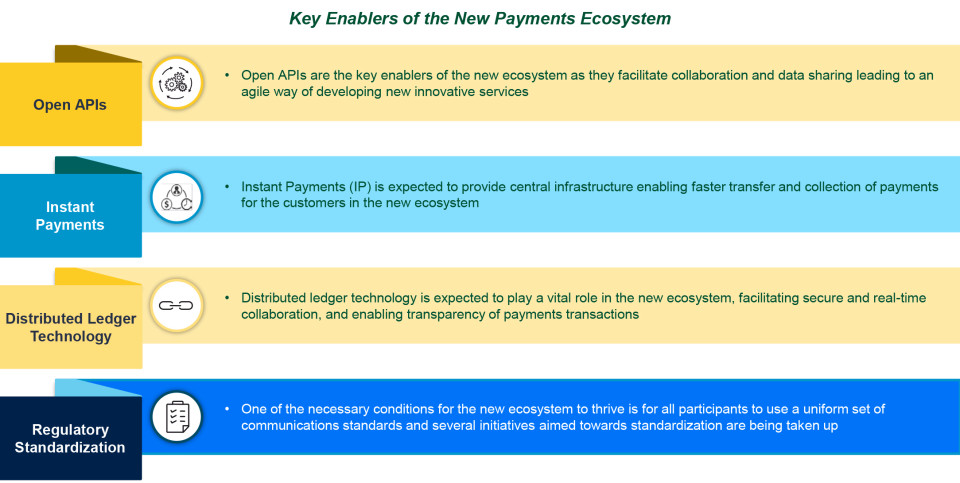

As this new, broader payments ecosystem takes shape, success factors include enthusiastic collaboration and willingness from all stakeholders to keep an open mind when it comes to next-generation payment-enabled technologies such as APIs, instant payments, and distributed ledger technology (DLT).

Source: Capgemini Financial Services Analysis, 2017; World Payments Report 2017.

Open APIs

APIs have evolved from use within the bank or with key partners, to become public, or open. Initially, banks used APIs to increase the agility and efficiency of internal business processes and used partner APIs to expand business, add new services, or open new channels. Today, open APIs are critical enablers because they facilitate collaboration and data sharing, which are so vital to the agile development of new and innovative payments services.

Globally, banks are at different stages of building their API marketplace, building platforms, or taking steps such as hackathon sponsorships and innovation labs to increase industry adoption of APIs. Many leading banks across the globe have developed API marketplaces to collaborate with FinTech firms to provide retail and corporate payments-related products and services. Similarly, London-based, mobile-only partnered with a banking-as-a-service platform last year to issue its customers UK bank accounts in real time and access to the UK’s Faster Payments Service.

Instant payments

Another ecosystem success factor is the establishment of global instant payments (IP) schemes. Instant payments initiatives fall into two categories – private or community efforts. Private initiatives are based on payment service providers’ networks and build on existing payment schemes. Some examples are Zelle in the United States, Siirto in Finland, Jiffy in Italy, and Bizum in Spain.[5][6][7][8]

Based on the SCT and SCTinst schemes, Jiffy is already integrated with the pan European instant payments infrastructure RT1. These apps are mainly used for real-time, person-to-person (P2P) payments and person-to-business (P2B) mobile payments for purchases at physical stores or e-commerce stores.

Financial regulators support community initiatives, which usually focus on creating new 24x7, real-time, and account-to-account payment infrastructures. Examples include IP infrastructures currently under development in Europe, Canada, and the United States. Australia’s New Payments Platform (NPP),[9] which is an open access infrastructure for fast payments, went live in February 2018. NPP also supports real-time settlement of transactions.

As a standalone solution, instant payments may offer corporates limited benefits such as faster money transfer and collection. However, when combined with open-banking directives, instant payments offer significant value to e-commerce traders and B2C retailers through instant access to their funds, which leads to substantial working capital and liquidity-related benefits. As more countries implement instant payments, corporate treasurers will have to upgrade their batch-processing back-end systems to real-time processing to derive the most benefits. IP is expected to provide a central infrastructure that enables faster payments transfer and collection.

Distributed ledger technology (DLT)

DLT can potentially help facilitate transparent, secure, fast, and cost-effective payment transactions in the new payments ecosystem. Banks such as BNP Paribas and RBC in collaboration with SWIFT are experimenting internally with DLT to develop digital payments platforms that can scale to deliver cross-border payments. BNP Paribas ALM Treasury have completed a pilot demonstrating the use of blockchain to improve operational efficiency by providing a more integrated cash management approach between businesses, allowing greater flexibility and a 24x7 capability.[10] Some leading banks have entered into partnership with Ripple to provide DLT based cost-effective solutions for low value cross-border remittances, international cash pooling, and conditional transfers to their clients. However, the existence of different standards for these diverse solutions may lead to interoperability challenges in the short- to mid-term, eventually resulting in consolidation in the industry in the longer term.

SWIFT’s DLT pilot test for bank-to-bank transfers was successful and demonstrated that DLT could provide the functions needed for Nostro account reconciliation.[11] Industry participants are looking to address specific concerns such as scalability and security challenges, and with mitigation, DLT adoption may increase.

Industry standardization

A uniform set of communications standards is an essential success factor within the new payments ecosystem; and several standardization proposals are being considered, worldwide.

The Single Euro Payments Area (SEPA) is a payment-integration initiative of the European Union for simplification of bank transfers denominated in euro (€). The FIDO (Fast Identity Online) Alliance is a consortium that focuses on biometrics to address the lack of interoperability among authentication devices.

Some API standardization initiatives such as the Banking Industry Architecture Network (BIAN), Open Banking Working Group (UK), Open Financial Exchange (United States), and the Open Bank Project (Germany) are expected to further increase the adoption of APIs in both retail and corporate payments.

SWIFT GPI, which has onboarded more than 150 leading banks, could emerge as the new standard in cross-border payments.[12]

Nexo standards are ISO 20022-based, open and global standards aimed at removing the barriers present in current fragmented global card payment acceptance ecosystem to enable interoperability in payment acquisition space across different regions. However, there are still standardization and harmonization challenges that are slowing the pace of ecosystem development. Disunity is the result of the diverse standards of various national regulators as well as disparate interpretation of regulations. For example, as PSD2 is transposed into national laws across European Member States, a lack of harmonization is apparent. Moreover, the absence of a central API infrastructure has resulted in banks in different countries creating open API platforms by collaborating with a range of industry stakeholders.

More efforts such as those from the Berlin Group, an independent body for establishing payment standardization under PSD2, are expected throughout the months ahead. The ultimate panacea will be built around a robust governance model, secure authentication methods, and standard technical and security standards for all payments communications. Firms must not compete at the level of infrastructure and standards, instead they must differentiate from competition based on the overlay services that they build on top of the centralized infrastructure bringing value to their clients. This will ensure that the greatest value is being offered to clients, without them having to worry about varying standards and the need for diverse infrastructure

For more insights on how the payments industry is evolving, and what this means for you, please download a complimentary copy of the World Payments Report 2017 developed by Capgemini and BNP Paribas, at www.worldpaymentsreport.com

[1] The Open Banking Working Group is a collective of banking, open data and FinTech professionals. It was formed in 2015 at the request of the UK government and aims to develop a framework for adopting an open API standard across banking and explore how open banking will impact consumers, regulators and industry.

[2] IndiaStack is a set of APIs that allows governments, businesses, startups and developers to utilize an unique digital infrastructure to help India enable paperless and cashless payments.

[3]Hong Kong Monetary Authority website, http://www.hkma.gov.hk/eng/key-information/press-releases/2018/20180111-3.shtml, accessed March 2018.

[4]Finextra website, https://www.finextra.com/newsarticle/31748/canadian-government-to-review-merits-of-open-banking, accessed March 2018.

[5]Reuters, “U.S. banks move to broaden reach of Zelle instant payments app,” David Henry, https://www.reuters.com/article/us-usa-banks-payments-zelle/u-s-banks-move-to-broaden-reach-of-zelle-instant-payments-app-idUSKCN1BJ1GO, accessed March 2018.

[6]Tieto website, https://campaigns.tieto.com/payments-ecosystem, accessed March 2018.

[7]SIA website, http://jiffy.sia.eu/en/send-receive-money-with-jiffy, accessed March 2018.

[8]Bizum website, https://bizum.es, accessed March 2018.

[9]Reserve Bank of Australia website, https://www.rba.gov.au/media-releases/2018/mr-18-02.html, accessed March 2018.

[10]BNP Paribas website, https://group.bnpparibas/en/press-release/bnp-paribas-ey-explore-private-blockchain-optimize-bank-s-global-internal-treasury-operations, Accessed March 2018

[11]Coin Telegraph website, https://cointelegraph.com/news/swifts-blockchain-pilot-for-bank-to-bank-transfers-went-extremely-well, Accessed March 2018

[12]SWIFT website, https://www.swift.com/our-solutions/global-financial-messaging/payments-cash-management/swift-gpi/members, accessed March 2018.

Authors:

Jan Dirk van Beusekom

Executive Director of Cash Management

at BNP Paribas

Christophe Vergne

Cards and Payment Practice Leader

at Capgemini