Receivables are what keep a company or institution in business. They are the final step of the Cash Conversion Cycle and close the gap in the Working Capital. In other words, Receivables are really important for a treasurer and yet often seen as a difficult topic to address. Inefficiency and frustration in the collection process often arise from the complexity in understanding the position of the payer.

Performing collections comes down to three main challenges: local payment culture, selection of collection instruments and collections matching.

Payments culture

Get inside the world of the payer

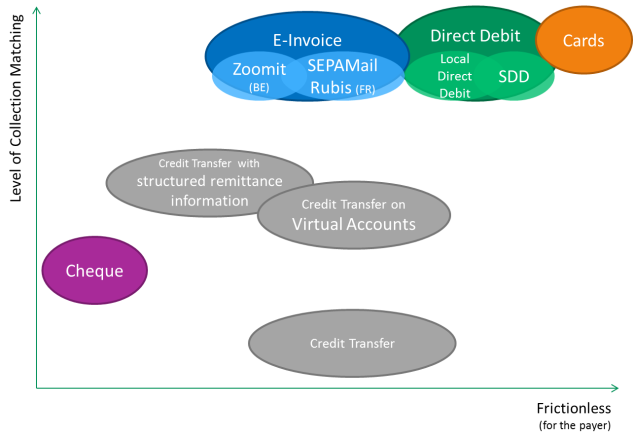

The efficiency of a collection product is often defined by the impact it has on the payer. This is mostly observed in commercial payments – both in brick-and-mortar shops as well as in e-commerce – where merchants are looking for frictionless payments to ensure that the last step of the sales journey is as smooth as possible.

The efficiency of any collection instrument itself is undeniably depending on the collaboration of the payer. Considering how you would like to pay yourself – either personally or professionally – may already give a good idea of the position of the payer.

Local payment culture

One of the factors that is difficult to influence is the payment culture of a certain country. Culture in each country often has a bias towards a certain category of instruments, due to legacy products. Statistics of the European Central Bank show clear preferences. Taking this cultural appetite into consideration in the selection of the proposed collection method can reduce friction and increase efficiency.

The Single Euro Payments Area [SEPA] offers a high level of standardisation in a large geographical area, making the effort for implementation reasonably small.

Success and efficiency of the implementation of SEPA is not in the ability to process them, but in the value they offer to the business and customer relationship.

Nevertheless, the biggest achievement of the harmonised landscape is the momentum of innovation to connect payer and beneficiary. Faster, easier and richer means of payment are around the corner, but the acceptance by the payer will determine its success. Optimising the use of already implemented payment instruments will most likely bring the highest return for businesses today. Making a selection of the most optimal means of payment for each business activity and each payer segment is a critical success factor.

Collections matching

Two of the most noticed complaints of payers – both professionals and consumers – are the management of outstanding invoices and the manual encoding of payment information. At the receivables side, the most noticed complaints are receivables forecasting and matching the collected funds with the outstanding receivable.

Direct debit products are initiated by the beneficiary of the funds, so all of the above complaints are addressed. However, some payer segments do not appreciate what they call a lack of control. Countries that traditionally have a low appreciation for direct debits, have installed different solution based on Credit Transfers. Some countries installed Peer-to-Peer e-invoice solutions, others developed structured or extended remittance information’s to guarantee collection matching. BNP Paribas developed a virtual accounts offer to increase collections matching on incoming flows that may seem difficult to optimise.

BNP Paribas has its finger on the pulse on the evolution of collections and the needs of companies both locally and globally. Having one of the largest local footprint in Europe provides us with a deep knowledge of local practices, cultures and solutions. Combining this with our comprehensive and reliable global channels offers a strategic advantage for your collections. We invite you to optimise and innovate together with us your collection strategy.