Robotic process automation (RPA) is based on the concept of software robots becoming virtual workers. The use of RPA helps organisations to understand and carry out repeatable work and ‘trains’ process-based applications to interact with structured and unstructured data.

RPA automates routine and time-consuming tasks and boosts efficiency and reliability. The technology consists of software robots, or bots, which can imitate a human worker and can log into applications, enter data, calculate and complete tasks and then log out.

There are three main categories of bots:

- - Probots follow simple, repeatable rules to process data

- - Knowbots search the internet to collect specific information

- - Chatbots or virtual agents can answer customer’s queries in real time

‘Robo treasury’ is a buzzword that has caused both excitement and anxiety among treasurers, some of whom have wondered if their days are numbered. The bots are trained to use applications without modifying them, and follow rule-based workflows in much the same way as human employees. They are particularly useful where interfaces have not yet been automated and data needs to be accessed and processed manually.

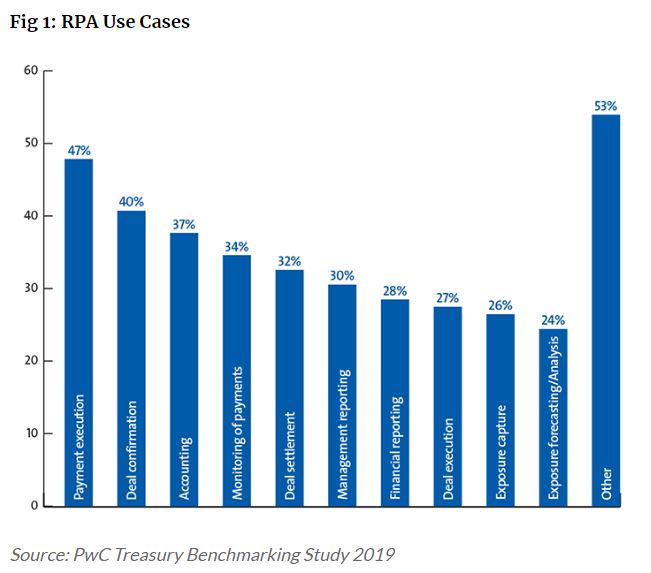

Core treasury responsibilities that involve large numbers of repetitive actions, such as cash management and payments, processing account statements, cash positioning, cash forecasting and payment fraud detection, are all processes that can be carried out by RPA technology.

The growth of RPA technology is without doubt affecting treasury and time spent manually updating quantities of data will certainly reduce. The real benefit for treasuries, therefore, is that RPA can eliminate the tedious yet necessary processes required on a daily basis, thus enabling highly skilled professionals to concentrate on adding value, meaning human input will remain of great tactical and strategic importance.

Robotic process automation 2.0, or ‘unassisted RPA’, is the second generation of RPA-related technologies and will see RPA combined with developments such as artificial intelligence.

"At BNP Paribas, we are increasingly using RPA in various parts of the bank. For example, in cash management we deploy RPA in our daily contract and service management, thereby increasing the quality and timeliness of our client service. RPA enables us to capture client information and reflect it across all of the relevant systems in the bank – avoiding silos and re-keying." - Steven Lenaerts, Head of Product Management – Global Channels, BNP Paribas