by Bruno Mellado, Head of International Payments and Collections, BNP Paribas Cash Management

While many developments and innovations have initially been targeted at the retail banking sector (i.e., individuals) where customer experience is key, corporate treasurers will increasingly expect a comparable level of digitisation, sophistication and quality of the customer experience in a business context. The question is whether banks or financial technology (fintech) companies are best positioned to respond to these changing needs.

The innovation dilemma

Competition amongst non-bank financial service providers has accelerated in recent years and forthcoming regulation changes in Europe will further boost the pace of change. European Union agencies are striving to create a level playing field for services across Europe, including financial services. However, this is happening in a context of low banking margins (which are likely to continue), demanding regulatory and compliance rules, and the need for higher liquidity ratios based on stable cash deposits linked to daily banking operations under Basel III.

Traditionally, large banking players have focused on running stable and reliable ‘factories’ to handle high transaction volumes. The core applications used to deliver robust, secure transaction processing, which have often been established for a number of years, have performed remarkably well. On top of this, operational requirements and regulatory compliance have become increasingly demanding. As a result, banks have been focusing on running operations and their business rather than transforming it.

In contrast, fintechs that do not have the same legacy of large-scale transaction processing and regulatory compliance have been able to develop innovative, targeted services based on new technologies and business models. What has become increasingly apparent is that corporations need both: the stability and scale that banks offer to provide liquidity and regulatory certainty, in addition to the ideas brought by new entrants to enhance cash and treasury operations.

Creating an integrated value proposition

Achieving rapid transformation to foster new ideas and smart use of new technologies is a major challenge for banks. If they do not do so – and quickly – there is a risk that they will become back-office organisations, with efficiency and scale as their hallmarks but ultimately with very low profitability. However, new entrants trying to acquire direct corporate customers in targeted fields like international payments have quickly come to realise that corporates need an integrated as opposed to a piecemeal approach. Specifically, treasurers and finance managers need solutions that address their overall liquidity challenges, that support compliance with a variety of regulations, and that provide access to a larger, complementary range of services.

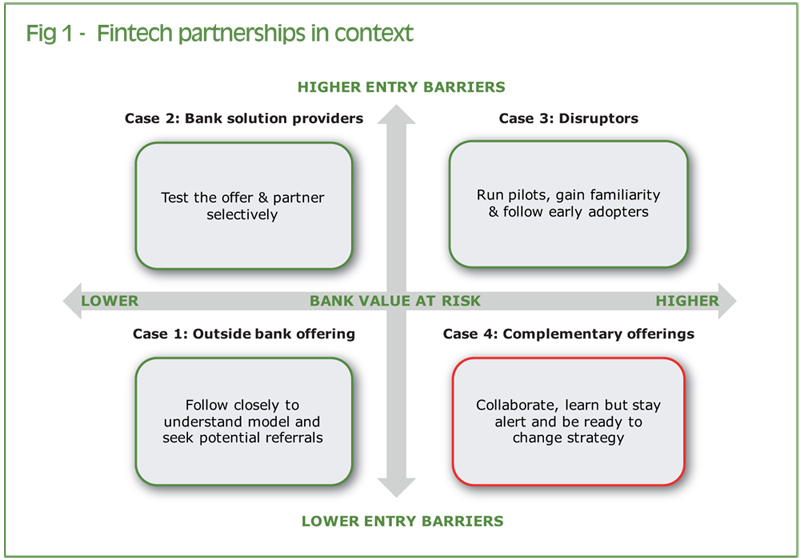

The issue for banks therefore, is not how they should fight against new entrants but how they can partner and integrate innovative fintech offerings that offer specific value to their customers. Given that growing competition means that time is of the essence, how should they do this? We believe that banks should plan their innovation strategy and engage with fintech by asking three key questions: 1) What is the value at risk? 2) How high are the entry barriers in relevant activity? and 3) What change is likely in future?

Case 1 - Fintechs operating outside the banking space

When fintechs offer solutions that do not compete with bank offerings, there is no value at risk, such as alternative sources of lending where there is no bank involvement. For example, peer-to-peer platforms can be used to lend money with an innovative, data-based risk management approach. A well-known example is the Lending Club that matches those who need funds with those willing to lend based on different investment criteria.

Banks should keep a close eye on these evolving businesses and learn from these models. A large bank in the US, for example, partnered with a similar ‘alternative funding’ fintech targeting small businesses, and gained new accounts and cash management customers as a result. Similarly, BNP Paribas Fortis has taken an important role at MyMicroInvest, a crowdfunding platform that offers investment opportunities in high potential start-ups and SMEs.

Case 2 - Fintechs offering a solution to banks

Often founded by former bankers who are well aware of the potential market niches, those companies identify a key process or area of inefficiency in the current banking set-up and create solutions based on a smarter use of technology. One example is a fintech that offers an international cash clearing network that complements a bank’s international payments offering. Such companies will enrich a bank’s cash management offering and leverage its multi-banking position. Although they can target prospective corporate customers directly, it is difficult for them to disintermediate the banks altogether as liquidity, compliance and treasury operations will weigh heavily in a corporation’s decision process. In such cases, banks will evaluate the offerings of fintechs by running smart pilots and then build selective partnerships to establish models that benefit bank, fintech and customers alike.

Case 3 - Fintechs bringing disruptive technology

Some fintechs offer disruptive services that have the potential to fundamentally change the market and the competitors within it, including those that have previously operated outside financial services. It will take longer for these initiatives to become a reality as a certain number of players is necessary to create critical mass and drive wholesale change. This is the case amongst fintechs specialising in distributed ledger technologies to find alternative means of transaction settlement. In such cases, both banks and corporate customers will trial the transforming technology for specific use cases and involve key fintech players to run controlled pilot programmes. The purpose is to acquire the internal capabilities in order to follow the early adopters and be part of the first new ecosystems.

Case 4 - Fintechs building on top of current bank offerings

Some fintechs harness banks’ infrastructures and are willing to create partnerships, collaborate and develop win-win models. Banks should engage with them as part of a learning curve, keep track of how new players evolve, and search for new partnerships. For example, digital wallet providers tend to partner with large institutions and banks, and in some cases their solutions are accepted and integrated into the bank’s platform. In such cases, co-creation is a good option but banks should be ready to adapt their strategy in line with the evolution of the competitive landscape.

Conclusion

In conclusion, while new digital and dematerialised services are creating new and in some cases disruptive opportunities, skills, expertise and the ability to build long-term relationships will remain paramount for corporate treasurers and finance managers acquiring cash management services. This particularly applies when looking at working capital solutions and sourcing advisory services. As a result, banks’ main competitors will remain their traditional peers; however, banking players who partner with, and acquire extra knowledge and solutions from fintechs are likely to gain a competitive edge and become the pioneers of future breakthrough solutions for treasurers.